Oilseeds: at the center of food, water, and energy security

By Kellyn Betts

July/August 2012

During the AOCS 103rd Annual Meeting and Expo, inform distributed a “Be Heard” survey in which attendees were asked to identify the most important challenges for fats and oils in the next 10 years. The majority of respondents indicated that the sustainable use of food, water, and energy by the world’s growing population will be the most pressing challenge. Here, science writer Kellyn Betts explores the interrelatedness of these critical resources, how fats and oils are at the center of the choices and tradeoffs that will need to be made, and how some top companies are changing the way they do business to ensure the security of these resources.

The United Nations’ Food and Agriculture Organization (FAO) predicts the world’s farmers will need to produce 70% more food to feed more than 9 billion people by 2050 while simultaneously combating poverty and hunger and adapting to climate change. The production, processing, and use of oilseed crops present additional challenges, because they are increasingly being used as feedstocks for fuel, chemicals, and other consumer products.

“We’re moving toward a greater and greater reliance on agriculture to supply society’s needs around food, fuel, and materials,” says Dave McLaughlin, vice president of agriculture for the World Wildlife Fund (WWF), a nonprofit conservation organization that is working on sustainability issues with 10 high-profile multinational corporations, including Cargill, Procter & Gamble (P&G), and Unilever. “The key questions are whether we have the land and the water to support all this agricultural production, and how that production will affect biodiversity, natural forests, and habitat.”

Only a tiny proportion of today’s crops and products are intentionally raised or produced sustainably, says Barbara Bramble, senior program advisor for the International Climate and Energy program for the US-based National Wildlife Federation. Bramble chairs the Roundtable on Sustainable Biofuels (RSB), the global initiative to certify biofuels that meet voluntary standards for social and environmental safeguards. RSB standards cover not only soil, water, and habitat conservation but also protection of local communities, land rights, and fair treatment of workers. “We need a lot of demand by companies asking for the right thing to cause overall improvements in the way crops are grown,” she says.

Meanwhile, production of the four most important oilseeds—palm, rapeseed (canola), soy, and sunflower—is rising. The Food and Agricultural Policy Research Institute, a joint effort of the Center for Agricultural and Rural Development at Iowa State University (Ames, USA) and the University of Missouri-Columbia (USA), predicts that worldwide oilseed harvests will increase by 11% between 2011 and 2015. While the United States, Brazil, China, Argentina, Indonesia, Malaysia, India, and the European Union (EU) are expected to continue to be the major producers of oilseeds through the end of the decade, new plantings are projected to increase mostly in emerging and developing countries despite environmental constraints and competition for land.

The United States, 27 nations of the EU, and more than 30 other countries in the Americas, Africa, Asia, and Asia-Pacific have passed or are implementing biofuel blending requirements. As a result, “all of the world’s major oilseeds are being used in biofuels,” McLaughlin says. The share of vegetable oil used for biodiesel is expected to increase from 10% in 2008 to 10–15% in 2020.

It’s already clear that shifts in the use of oilseeds for fuel have caused changes in food oil consumption patterns, points out Rosamond Naylor, director of the Center on Food Security and the Environment at Stanford University (California, USA). As the amount of rapeseed used for fuel in Europe has grown, China has imported lower amounts. Instead, Chinese citizens are using more soy and palm oil for cooking, she says.

A positive side effect of the food-price spike of 2007–2008 was that it inspired the World Bank as well as developed countries to double their investments in developing nations’ farming. It also helped raise the status of agriculture in many developing countries. Concerns about having enough domestic acreage devoted to food production led China’s National Development & Reform Commission in April 2011 to limit alcohol, biofuel, and other nonanimal-feed projects that use grain and edible oils.

Companies such as P&G and Unilever are leaders in planning for scarcity and in identifying the need for sustainable supplies. Forward-looking consumer goods manufacturers recognize that the market will demand products that are produced much more sustainably a decade from now, and the changes required to offer such wares take time to implement, says Jan-Kees Vis, the global director of Unilever’s Sustainable Sourcing Development. In April 2012, Unilever announced that it was installing a €100 million palm oil refinery in Sumatra (Indonesia) to guarantee the sustainability of its palm oil supply, in support of the company’s commitment to source all of its renewable raw materials from sustainable sources by 2020.

In addition to committing to ensuring that the oilseed-based commodities used in its products are grown and produced sustainably, P&G has vowed to replace 25% of its petroleum-based raw materials, such as alkyl surfactants, alkyl ethoxylate surfactants, and linear alkylbenzene surfactants, with alternative formulations based on renewables by 2020, says Len Sauers, P&G’s vice president for global sustainability. This is important because approximately one-fifth of the world’s oilseeds are consumed for industrial products (inform 20:749, 2009), including soaps and detergents, biodiesel, lubricants, drying oils, inks, and hydraulic oils.

Pressure by ethical investment and banking organizations also moves consumer goods manufacturers, oilseed distributors, and retailers toward sustainability. P&G is one of the top holdings in Calvert Investment’s Calvert Social Responsibility Index, which includes large companies that the firm judges to perform well on seven metrics. One is to “demonstrate good environmental compliance and performance records, develop and market innovative products and services, and embrace and advance sustainable development.” Investors need to consider companies’ abilities to secure resources in the future, explains Ellen Kennedy, manager of Environment, Water, and Climate at Calvert Investments. “If the land or labor or water or other resources aren’t being used sustainably, there’s a risk to that company that they may not be able to secure a fair price for that resource in the future.”

Moving toward nonfood sources

To Bramble, the relatively small quantities of vegetable oil-based biofuels in current use increase the amount of flexibility that nations have in response to petroleum oil price shocks.

Vis says that Unilever is “concerned about the first-generation biofuels because they are in direct competition with food. . . . If a feedstock is a food, how can you not compete with food?” he asks. Although he is optimistic about the promise of second-generation biofuels in the longterm, “As long as the [governmental] subsidies are behind first-generation biofuels, such as biodiesel from vegetable oils, it is very difficult for the second-generation biofuels to actually enter the market,” he points out.

Sauers says that although P&G is investigating some alternatives to food-based chemicals to meet its commitment to cut its use of petroleum-based chemicals, he believes that in the long run there will be more pressure to move toward nonfood sources, such as cellulosic sugars from grasses. Finding alternatives that do not increase the company’s carbon footprint is a real challenge because petroleum is a very efficient source of carbon, he points out.

Farming improvements

A positive side effect of the increased demand for edible oils has been to make farming more profitable and farmers more productive.

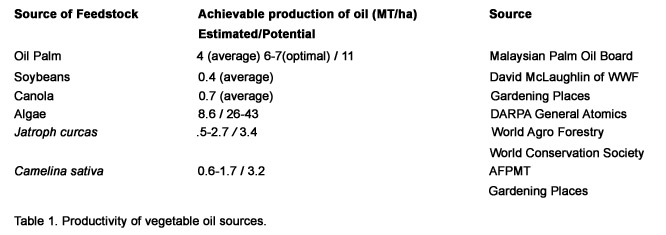

Of all the oilseed crops grown commercially, oil palms have the highest oil yield per hectare (see Table 1), and growers have been able to continually increase those yields, McLaughlin says. The average yields of oil palms is around 4 metric tons/hectare (MT/ha) in Malaysia, with slightly lower yields in Indonesia. In comparison, the global average yield of soybean oil is 0.4 MT/ha. However, the better oil palm producers are getting 6–7 MT/ha, and there are reports of planting materials that can increase yields to 11 MT/ha, he says. Better management practices, including improved harvesting and better plant nutrition of the existing cultivation base could increase yields by 15–30% while using practices that would enable growers to achieve certification through the Roundtable for Sustainable Palm Oil, he says.

In a Conservation Biology article (25:1117–1120, 2011), McLaughlin points out that “palm oil can be a sustainable crop, have minimal effects on biological diversity, sequester carbon, produce jobs, and offer attractive financial returns.” Most of the issues related to palm oil that have come to light are the result of how palm oil has been developed, he says.

New oil sources and modified oilseeds

Some promising nonfood or so-called second-generation and advanced agricultural sources of oil-based biofuels are jatropha, camelina, and algae. Algae has the potential to revolutionize the production of biofuel, but it will take the longest to develop as an energy source.

A number of governmental agencies as well as private and publicly held companies are attempting to bring oil derived from algae to market. Tests by the US Defense Advanced Research Projects Agency (DARPA) have shown algae can produce more than 1,000 gallons of oil per acre (9,354 liters/ha), far more than the 400-800 gallons/acre that palm generates. Many companies are working to develop algae as a source of biodiesel, such as OriginOil, Sapphire, ExxonMobil, Synthetic Genomics, Solix, Solena, Aurora Algae . . . and the list goes on. General Atomic (headquartered in San Diego, California, USA) considers claims that microalgae have the potential to produce 3,000–5,000 gallons of oil per acre to be credible. “It may be possible to produce enough biodiesel from microalgae to supply all US transportation fuel requirements,” according to a recent company statement.

Algae’s ability to grow on degraded land with poor-quality water while generating a net gain in energy and reduction in carbon dioxide makes it especially compelling, McLaughlin says. However, some of the most recent research into producing biodiesel from algae suggests that it may need to be done in conjunction with other processes, such as treating wastewater or producing other high-value commodities, in order to be cost-effective (http://tinyurl.com/algae-caveats).

The tropical shrub Jatropha curcas can yield 400 gallons of oil per acre from seeds containing 30–40% oil. Over the past decade, jatropha has been planted across Asia and sub-Saharan Africa, and more recently South America has also begun planting the crop. Bloomberg New Energy Finance predicts that by 2018 aircraft fuel from jatropha could be produced for $0.86 per liter, about the same price as conventional jet fuel today and far less than fuel made from soybeans or palm can be processed into biodiesel, and the residual materials can be used as a soil conditioner or processed as biomass to power electric facilities. Although jatropha has not thrived as well as expected when grown on wasteland and may require more water than initially believed, researchers are developing new hybrids and genetically modified strains to enhance yields (e.g., SG Biofuels Inc., JOil Singapore Pte Ltd.). Genetic engineering also has the potential to enhance the production of oil by other plants (inform 23:206–210, 2012).

Camelina, another oilseed-bearing plant, is able to withstand cold temperatures. It can be planted as a follow-along crop in wheat fields for harvest in the spring, thereby increasing the amount of useful material that can be grown on the same land. Bramble sees crops such as camelina as key to increasing the world’s ability to expand its agricultural productivity. An article in the November/December 2011 issue of inform (22:604–616) discussed the potential of camelina seed for use in fuel, animal feed, and other applications.

RSPO and the chain of custody

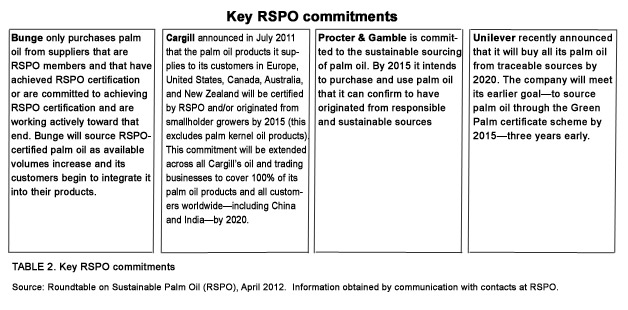

Owing to the popularity of outsourcing over the past 20–30 years, large companies did not know until recently what others in the supply chain—farmers, processors, distributors, and others who collaborated to deliver commodities such as oilseeds—were doing, McLaughlin explains. Certification programs such as the RSPO and the Round Table for Responsible Soy (RTRS) target the farmers, distributors, and processors at every level of the supply chain for palm and soy because “the chain of custody is critically important,” McLaughlin explains. The availability of certificate programs such as Green Palm [sponsored by the RSPO] helps companies publicly support growers who use sustainable practices before those companies can shift to segregated oil or shipments that can be tracked throughout the entire supply chain. Key commitments made by four global palm oil users are described in Table 2.

Companies must be buying critical volumes before the segregation requirements for certification processes such as RSPO and RTRS become cost effective, Vis points out. “We understand that this is very, very challenging for companies because a lot of times commodities are blended,” Kennedy says.

Traceability can also help buyer companies manage their reputations, Calvert Investment’s Kennedy explains. Company and brand reputation are key to company performance, and companies that have very valuable brands can be easy targets, she says. “Even if it is unfair that a company is being blamed for something in its supply chain, with the lightning-fast communications now available in the world of social media, it doesn’t matter,” she says. Companies are increasingly realizing that they need to manage the risk of their suppliers, and even in some cases, their suppliers’ suppliers, to protect their brands, she says.

Water and energy

In March 2012, the United Nations Educational, Scientific and Cultural Organization forecast that the world’s farmers will need 19% more water by 2050 to meet increasing demands for food, much of it in regions already suffering from water scarcity. By that time, the FAO predicts that water scarcity will reach alarming levels in an increasing number of countries or regions within countries, particularly in the Near East/North Africa and South Asia. Using less water and at the same time producing more food will be the key to addressing water scarcity problems. Water scarcity could be made more acute by changing rainfall patters resulting from climate change.

Most of the water that a multinational company such as Unilever consumes is via the agriculture that produces the raw materials it uses, Vis says. For this reason, the company has standards that its farmers and suppliers must follow for irrigation and for controlling topsoil erosion and agricultural runoff.

Looking at the life-cycle impacts of oilseed crop growing is important, Bramble says. For example, oil palm trees are generally grown in very wet areas, such as swamps and rainforests, where rain provides all or most of the water they require. They are “huge users of water in the sense that they displace wetlands and peat lands,” Bramble says. Soy, canola/rapeseed, and sunflower can also be grown on rain-fed lands, so they can all be fairly efficient users of water, Bramble points out.

The most common impact on water from oilseed agriculture is contamination from fertilizers and chemicals such as herbicides and insecticides, says Kishore Rajagopalan, an associate director at the University of Illinois’ Sustainable Technology Center. This is why Vis says the field staff associated with Unilever’s suppliers usually go out into the fields throughout the growing season to check that farmers adhere to the types of pesticides they’re allowed to use on certain crops under certain conditions, and that they use the appropriate windows of spraying. Impacts can also arise when crops are planted or manufacturing facilities are sited without sufficient regard for their effect on local water resources, Rajagopalan says. He believes this is most likely to happen in the developing world.

An increasing number of companies throughout the world are taking steps to reduce their use of water during oilseed processing by reusing it, Rajagopalan says. For example, after biodiesel is washed with water to remove contaminants, the water can be cleaned and reused. Other companies recycle water from their cooling towers, rather than sending it down the sewer to water treatment plants, he says. He urges companies to consider what quality of water they need for different purposes and recommends shifts to use of lower-quality water when possible, as well as reusing contaminated water in situations where it is feasible. Another option is to clean up the water effluent before reusing the water.

Water and energy use tend to be interrelated because water is generally used for cooling in processing plants, Rajagopalan says. Efforts to reduce heat losses within processes by finding a different use for that heat can result in saving both water and energy, he says. “One of the things I look for is why companies are using water,” he says. “If it is being used to remove heat, I ask if the heat can be used elsewhere or if you can avoid using water to cool it down.”

Kellyn Betts is a freelance writer who has covered topics in environmental science, health, and technology for more than two decades. In 2005, she won an online reporting award from the Society of Environmental Journalists. She can be contacted at k_betts@nasw.org.

Life- cycle assessments

Both P&G and Unilever extensively use life-cycle assessment (LCA), a tool for quantifying the environmental impact—in terms of water, energy and raw materials usage and releases to air, land, and water—that products, packages, and processes have across their entire life cycles, including producing or harvesting the raw materials, manufacturing, use by the consumer, and disposal or recycling. LCA “helps us identify where the biggest opportunities are,” Sauers says.

P&G efforts to reduce water and energy use.

LCA analysis helped P&G discover that a major point of energy use associated with the life cycle of laundry detergents is when consumers heat water to wash their clothes. The recognition inspired the creation of P&G’s Tide Coldwater line of laundry detergents, as well as its sister products Ariel Cool Clean, which use oleo-based surfactants. The Coldwater and Cool Clean detergents are formulated to function optimally with unheated water. P&G advertises that Coldwater enables consumers to save up to 80% of the energy in each load of washing, as well as cutting the associated greenhouse gas emissions.

Kennedy of Calvert Investments calls Tide Coldwater’s ability to impact how consumers use water to do laundry “a huge advance.”

To help reduce the amount of water required to do laundry in the developing world, P&G sells a product called Downy Single Rinse. This fabric conditioner enables people to reduce the number of times they rinse laundered clothing from at least three to just once. “It helps sequester the suds,” Sauers explains. Consumers who use the product can cut their water usage for laundering in half, which Sauers says is meaningful in areas of water scarcity such as the Philippines.

P&G is also using what Sauers calls “product compaction” to concentrate products such as detergents by two to six times. This reduces the amount of water used to produce the products and saves energy in transportation, he says. However, the company’s policy is only to implement “no-tradeoff” solutions that do not incur a price premium.

Unilever efforts to reduce energy and water use.

Unilever has completed life-cycle assessments on 1,600 of its products to calculate their carbon and water footprints. Only 3% of the carbon footprint is in the company’s factories and offices, Vis says. Unilever has committed to halve the carbon and water imprints of its operations and products across their entire life cycles. About 68% of the carbon footprint of Unilever’s products is during the consumer-use phase, mostly to heat water for things such as cooking and bathing. “This is a challenge because there is a limit to what we can influence in terms of consumer behavior,” Vis says.

Bramble, Kennedy, McLaughlin, Rajagopalan, Sauers, and Vis all express optimism that the steps toward sustainability that they are observing or taking will have an important impact. As Bramble put it, “Our goal is that practices that were once exceptional will become the new business as usual.”